What is An Initial Coin Offering? Raising Millions In Seconds

The Initial Coin Offering gold rush – the future of fundraising or just another crypto scam?

If you are searching for the biggest trend in cryptocurrency today, a look at Initial Coin Offering (ICO) might be a good start. The idea to presale coins of a cryptocurrency or token of a blockchain project has evolved in a crazy successful instrument to raise funds for the development of a new application.

The amount of money that ICOs have raised over the last two years is truly astonishing. In 2017, ICOs raised a total of $5.6 billion. If that sounds shocking to you then think about this.

After seeing all these stats, it makes sense as to why more and more people are getting intrigued with ICOs. Our guide gives an overview on Initial Coin Offering- ICO and presents the hottest past, current, and future ICOs.

What is An Initial Coin Offering?

ICOs are basically blockchain crowdsales, the cryptocurrency version of crowdfunding. The ICOs have been truly revolutionary and have managed to accomplish many amazing tasks:

- They have provided the simplest path by which DAPP developers can get the required funding for their project.

- Anyone can become invested in a project they are interested in by purchasing the tokens of that particular DAPP and become a part of the project themselves.

It was in July 2014 when ICOs well and truly came into the public’s attention. That was when the ICO Ethereum raised $18.4 million and ushered in a new age of ICOs.

Since 2013 ICOs are often used to fund the development of new cryptocurrencies. The pre-created token can be easily sold and traded on all cryptocurrency exchanges if there is demand for them.

With the success of Ethereum, ICOs have become the de-facto method of funding the development of a crypto project by releasing a token which is somehow integrated into the project.

Short History of Initial Coin Offering

Maybe the first cryptocurrency distributed by an ICO was Ripple. In early 2013 Ripple Labs started to develop the Ripple called payment system and created around 100 billion XRP token. The company sold these token to fund the development of the Ripple platform.

Later in 2013, Mastercoin promised to create a layer on top of Bitcoin to execute smart contracts and tokenize Bitcoin transactions. The developer sold some million Mastercoin token against Bitcoin and received around $1mio.

Several other cryptocurrencies have been funded with ICO, for example, Lisk, which sold its coins for around $5mio in early 2016. Most prominent however is Ethereum. In mid-2014 the Ethereum Foundation sold ETH against 0.0005 Bitcoin each. With this, they receive nearly $20mio, which has become one of the largest crowdfunding ever and serves as the capital base for the development of Ethereum.

As Ethereum itself unleashed the power of smart contracts, it opened the door for a new generation of Initial Coin Offering.

Ethereum – The Initial Coin Offering? ICO Crowdfunding Machine

One of the easiest application of Ethereum’s smart contract system is to create a simple token which can be transacted on the Ethereum blockchain instead of Ether. This kind of contract was standardized with ERC#20. It made Ethereum host of such a wide scope of ICO that you can safely say that Ethereum found its Killer App as a distributed platform for crowdfunding and fundraising.

The most prominent demonstration of the potential of Ethereum’s smart contracts has been The DAO. The distributed investment company was fuelled with Ether worth $100m. The investors received in exchange against Ether Dao Token which had their own market price and enabled the holder to participate in the governance of the DAO. After it was hacked, the DAO however failed.

The concept of funding projects with a token on Ethereum became the blueprint for a new and highly successful generation of crowdfunding projects. If you already tried out, you know that investing in token on top of Ethereum is charmingly easy: You transfer ETH, paste the contract in your wallet – and, tata: The token appear in your account and you are free to transfer them as you want.

Before we go any further, let’s understand what tokens mean.

Tokens = ICO Cryptocurrency?

The word “token” gets thrown around a lot, however, more often than not, people simply don’t know what it means. To be honest, it can be extremely difficult to pinpoint an exact definition. Let’s at least start with a very broad definition:

A token is a representation of something in its particular ecosystem. It could value, stake, voting right, or anything. A token is not limited to one particular role; it can fulfill a lot of roles in its native ecosystem

Having said that, there is a difference between cryptocurrency coin and token. Coins like Ethereum, Bitcoin, and Bitcoin Cash are examples of cryptocurrency coin, since they have value outside their native environment.

However, projects like OmiseGO and Golem are tokens because they exist on top of an existing smart contract platform, like Ethereum.

According to the U.S. Securities and Exchange Commission (SEC) there are two kinds of tokens out there:

- Security Tokens

- Utility Tokens

Security Tokens

A crypto token that passes the Howey Test is deemed a security token. For a token to pass the Howey Test, it must fulfill the following conditions:

- Is it an investment of money?

- Is the investment in a common enterprise?

- Is there an expectation of profit from the work of the promoters or the third party?

Note: “Common Enterprise” is still open to interpretation. However, the majority of the federal courts define it as a horizontal enterprise where investors pool in their

Since most ICOs are investment opportunities in the company itself, the tokens classify as security. Security tokens are subject to federal securities and regulations since they derive their value from external, tradable assets.

Utility Tokens

On the other hand, if the token doesn’t pass the Howey test, then it classifies as a utility token. These tokens simply provide users with a product and/or service. Think of them like gateway tokens which can:

- Give holders a right to use the network

- Give holders a right to take advantage of the network by voting

So, now we know what an ICO is and what tokens are. Let’s actually look into the mechanism of how an ICO works.

How Does the ICO Crowdsale Work?

Smart Contract platforms like Ethereum and Neo allow developers to create their Dapps on them. Think of them like a decentralized supercomputer and the Dapps as the applications that one can execute inside.

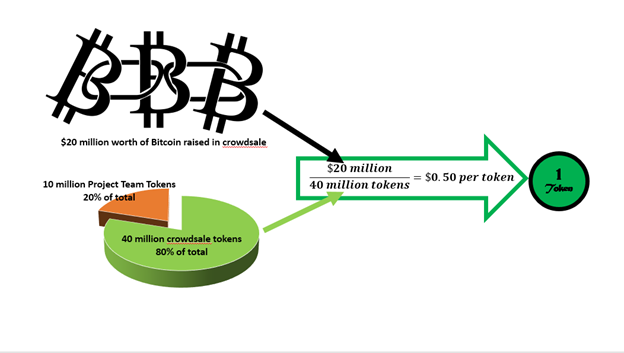

In order to gain funding for the project, the developer issues a limited amount of tokens (could be utility or security). It is important that the tokens have a limited amount because:

- It makes sure that the ICO has a goal to aim for

- As the demand rises and the supply of token diminishes, it makes sure that the value of the tokens will go up. The tokens have a predetermined price which may go up or down depending on the demand.

ICO trading is pretty simple and straightforward. If you want to buy some tokens, then you send some cryptocurrency (Ether if the platform is Ethereum) to the crowd-sale address. The moment you do that, you get the corresponding amount of tokens sent to your wallet.

Obviously, this is just a general overview. There is a lot of marketing that goes on leading up to the date of the ICO. In fact, paid advertising used to be so rampant that social media giants like Facebook and Twitter had to ban ICO-related ads on their platforms.

Pros and Cons of ICO Explained

Pros

- Most importantly, ICOs give promising projects an opportunity to shine. The prime example of this has to be Ethereum. Look at what it has achieved over the last 3 years. Not only has it become a part of our zeitgeist, they have provided an ideal platform for other projects to develop on top of them.

- Many projects in the “centralized world” never get to do their IPOs (Initial Public Offerings) because of the sheer amount of unnecessary paperwork involved. However, blockchain projects can simply take part in an ICO by presenting a good quality ICO whitepaper.

What is ICO whitepaper you ask?

It is a concisely written piece of documentation which presents the problem that the project is aiming to solve and the method that they will be following in order to solve it. Upon reading the white paper, the potential investors can choose to invest or not in the project. - Another brilliant thing that an ICO manages to do is to establish a rapport between the project and their community. Any ICO creator worth their salt will tell you how critical it is for them to develop a healthy community.

Quantstamp is a perfect example of this. They were able to raise all their ICO money organically because of their healthy relationship with their community. - The fact that blockchain crowdfunding was able to collect $6.8 billion in 4.5 months just goes to show how much hype and demand there is behind these projects. Such kind of exposure will do wonders for them.

- In a similar vein, ICO funding provides a huge incentive for developers to go the extra step and come up with more exciting and innovative projects.

- For investors, ICOs provide an opportunity for them to invest and discover the “next big thing.” Let’s give you the perfect example, Ethereum. During the ICO, 1 Ether was trading for 40-50 cents. As of right now, they are trading for $477 each.

Cons

- Remember how we told you earlier that one of the biggest pros of ICOs is the lack of paperwork involved? Unfortunately, it is a double-edged sword. Loads of scammers have entered this space hoping to make a quick buck.

They simply create a bogus white paper or omit some of the more important details off their whitepaper to make their projects seem more important and intricate than what they actually are. - When you are investing in a project’s ICO you are not actually investing in the project, you are investing in the idea of the project. As such, it works on pure speculation which is based on the quality of the white paper and the credibility of the team. So, you simply have no idea whether the project is actually going to be a success or not when you invest.

This is where certain cold-hard facts should be considered. 90% of the startups fails. Either the product doesn’t work or the developers get lazy. Also, as the DAO attack has shown us, even if everything is in place, a slight mistake in the code could be enough to send a project crashing down. - During the ICO sale, the presence of “crypto whales” could be problematic. The most infamous example of this is the BAT ICO. The ICO was able to raise a staggering $35 million in 24 seconds! It turned out that majority of the tokens were owned by certain individuals, which simply defeats the purpose of decentralization.

These individuals are called “crypto whales” or simply “whales.” These individuals use their significant financial clout to pay exorbitantly high transaction fees to “cut in line” of the waiting queue. During the BAT ICO whales paid as much as $2220 in transaction fees! - An ICO is an extremely laborious event for the blockchain, at least the way it is designed right now. The fact remains that blockchains are simply not scalable enough to take up heavy duty activity.

The $100 million Status ICO clogged up the Ethereum blockchain so badly that a lot of people simply weren’t able to participate because their transactions didn’t come through.

This can work in reverse as well.

The SophiaTX ICO had to postpone its date because the Cryptokitties game had clogged up and slowed down everything in the Ethereum blockchain. - Ethereum based ICO tokens are easy to store because they can be stored in any Ethereum wallet. However, things get tricky when it comes to other platforms. More often than not, these tokens may not be compatible with your wallet and storing them may be an extremely tiring and annoying exercise.

- Also, as you may already be aware of, ICOs are increasingly coming under the radar of regulatory bodies like SEC and CFTC. They have already made their presence known by making it compulsory for US-based ICOs to declare whether their tokens are securities or not.

- Finally, the next step to increased regulation is government intervention. Because of the vast amount of unregulated money that ICOs are dealing with, the government may consider them unsafe and simply ban them in their countries. China and India are ideal examples of this.

Legality of ICOs

The legal state of ICO is mostly undefined. Ideally, the token is sold not as a financial asset but as a digital good like many other things. This is why ICO is often called “crowd sale”. In this case, in the most jurisdiction, the funding with an ICO is not regulated, which makes it extremely easy and paperless, given a lawyer experienced with the issue is on board.

Having said that, ICOs have increasingly come under the scrutiny of regulatory bodies like the SEC and the CFTC because of the fact that most of the ICOs are securities. This gained a lot of traction when the SEC declared the Dao ICO as security.

Ash Bennington from Coindesk, breaks down why the Dao was deemed a security in the form of a tale:

“Not so long ago, a group of developers started a DAO.

The DAO developers said:

“There are all these decentralized projects and there’s no way for them to get funding – because they need money to make money.”

Tell you what. We’re going to write code and sell a token and, in exchange, people who buy the token will get whatever profits are made from those projects.

We’ll work the code. They’ll pick the projects. The projects will flourish and everyone will profit.

The SEC said: “That’s a security.”

The DAO developers said: “No, no. That’s just selling tokens.”

Ultimately, the SEC said: “That’s a security” – because of the application of the Howey Test: There was an investment of money. And a common enterprise. With the expectation of profit, primarily from the efforts of others.”

So, why was this investigation and ruling done in the first place?

This is where we come to another reason as to why this space has become and will become increasingly regulated. The Dao was supposed to be the biggest ICO ever, however, a flaw in its code made it vulnerable and it imploded quite spectacularly.

We have covered this in detail before, but just to give you an overview:

- There was a flaw in the Dao smart contract

- The hacker exploited that flaw to execute a re-entrancy attack.

- Over $150 million worth of ether was siphoned away.

Because a lot of people invested and got back nothing in return, the SEC intervened to “protect” the interest of the investors and deemed the tokens a security.

As SEC CEO Jay Clayton puts it, “The SEC is studying the effects of the distributed ledger and other innovative technologies and encourages market participants to engage with us. We seek to foster innovative and beneficial ways to raise capital, while ensuring – first and foremost – that investors and our markets are protected.”

This decision was met with a mixed reception in the Crypto community:

Brad Garlinghouse, Ripple Ceo, said,

“Regulators aren’t going away – and shouldn’t. For generations, they have protected from fraud (some is happening w/ the ICO market).”

Roger Ver, Bitcoin.com founder, however, disagreed with the decision,

“Call this what it is: A bunch of strangers in a far-off land threatening peaceful people all over the world with violence if they don’t obey.”

Conclusion

ICOs have been an extremely hot topic for a couple of years now and we hope that we were able to throw some light on the subject for you. It will be interesting to see how future ICOs pan out and the regulations become more and more strict. Let’s hope that the increased regulations are going to have a positive effect by flushing out scammy ICOs.

What is An Initial Coin Offering? Raising Millions In Seconds

![What is An Initial Coin Offering? Raising Millions In Seconds]() Reviewed by Finvest

on

February 23, 2019

Rating:

Reviewed by Finvest

on

February 23, 2019

Rating:

No comments: